This post...

Originally Posted By: jeffoRobert Reich's Blog

Robert Reich was the nation's 22nd Secretary of Labor and is a professor at the University of California at Berkeley. His latest book is "Supercapitalism." This is his personal journal.

About Me

Name: Robert Reich

Latest book, "Supercapitalism," is now out in paperback. For copies of articles, books, and public radio commentaries, go to

www.robertreich.org. This blog is available as an RSS feed. Public radio commentaries are now available as a podcast.

View my complete profile

How You and I Are Paying Wall Street to Lobby Cong...

An Open Letter to Rush Limbaugh, Sean Hannity, and...

How America Embraced Lemon Socialism

The Banking Crisis (Continued)

Obama's First Choice

How the Ensure that an Aggregator (or Bad) Bank Is...

Why Citi Turned Around on Mortgage "Cramdowns"

What Should Be Done With The Next $350 Billion of ...

[Respite]

The Stimulus: How to Create Jobs Without Them All ...

Tuesday, January 27, 2009

Why We Need Stronger Unions, and How to Get Them

Why is this recession so deep, and what can be done to reverse it?

Hint: Go back about 50 years, when America's middle class was expanding and the economy was soaring. Paychecks were big enough to allow us to buy all the goods and services we produced. It was a virtuous circle. Good pay meant more purchases, and more purchases meant more jobs.

Not sure where this gentleman was at back in the 60s, but I certainly didn't see an overabundance of purchases going on.

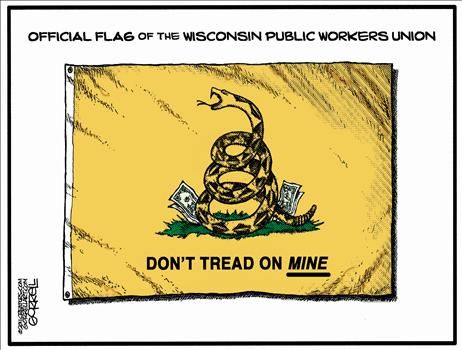

Originally Posted By: jeffoAt the center of this virtuous circle were unions. In 1955, more than a third of working Americans belonged to one. Unions gave them the bargaining leverage they needed to get the paychecks that kept the economy going. So many Americans were unionized that wage agreements spilled over to nonunionized workplaces as well. Employers knew they had to match union wages to compete for workers and to recruit the best ones.

And, the average wage at the time was what?

Originally Posted By: jeffoFast forward to a new century. Now, fewer than 8% of private-sector workers are unionized. Corporate opponents argue that Americans no longer want unions. But public opinion surveys, such as a comprehensive poll that Peter D. Hart Research Associates conducted in 2006, suggest that a majority of workers would like to have a union to bargain for better wages, benefits and working conditions. So there must be some other reason for this dramatic decline. But put that question aside for a moment. One point is clear: Smaller numbers of unionized workers mean less bargaining power, and less bargaining power results in lower wages.

It's no wonder middle-class incomes were dropping even before the recession. As our economy grew between 2001 and the start of 2007, most Americans didn't share in the prosperity. By the time the recession began last year, according to an Economic Policy Institute study, the median income of households headed by those under age 65 was below what it was in 2000.Typical families kept buying only by going into debt. This was possible as long as the housing bubble expanded. Home-equity loans and refinancing made up for declining paychecks.

This recession has long been in effect, it has only recently hit home because the government is no longer able to artificially inflate the economy. The housing boom of the late 90s early 00s was made possible by government backing. They were trying to bail the economy out then. The legislation enacted to do so was put into place during the Carter administration.

Originally Posted By: jeffoBut that's over. American families no longer have the purchasing power to keep the economy going. Lower paychecks, or no paychecks at all, mean fewer purchases, and fewer purchases mean fewer jobs.

The way to get the economy back on track is to boost the purchasing power of the middle class. One major way to do this is to expand the percentage of working Americans in unions. Tax rebates won't work because they don't permanently raise wages. Most families used the rebate last year to pay off debt -- not a bad thing, but it doesn't keep the virtuous circle running. Bank bailouts won't work either. Businesses won't borrow to expand without consumers to buy their goods and services. And Americans themselves can't borrow when they're losing their jobs and their incomes are dropping.

And, who is going to have the income to support everyone being back in the union? Because union negotiations mean higher wages, and more benefits. All of which someone, somewhere down the road, has to pay for. Why not simply pay our own way, rather than rely upon passing those costs on to someone else through costs increases in products offered.

Originally Posted By: jeffoTax cuts for working families, as President Obama intends, can do more to help because they extend over time. But only higher wages and benefits for the middle class will have a lasting effect.

Unions matter in this equation. According to the Department of Labor, workers in unions earn 30% higher wages -- taking home $863 a week, compared with $663 for the typical nonunion worker -- and are 59% more likely to have employer-provided health insurance than their nonunion counterparts.

Examples abound. In 2007, nearly 12,000 janitors in Providence, R.I., New Hampshire and Boston, represented by the Service Employees International Union, won a contract that raised their wages to $16 an hour, guaranteed more work hours and provided family health insurance. In an industry typically staffed by part-time workers with a high turnover rate, a union contract provided janitors with full-time, sustainable jobs that they could count on to raise their families' -- and their communities' -- standard of living.

In August, 65,000 Verizon workers, represented by the Communications Workers of America, won wage increases totaling nearly 11% and converted temporary jobs to full-time status. Not only did the settlement preserve fully paid healthcare premiums for all active and retired unionized employees, but Verizon also agreed to provide $2 million a year to fund a collaborative campaign with its unions to achieve meaningful national healthcare reform.

And, that is largely a part of why my cell phone bill is $400/month.

Originally Posted By: jeffoAlthough America and its economy need unions, it's become nearly impossible for employees to form one. The Hart poll I cited tells us that 57 million workers would want to be in a union if they could have one. But those who try to form a union, according to researchers at MIT, have only about a 1 in 5 chance of successfully doing so.

The reason? Most of the time, employees who want to form a union are threatened and intimidated by their employers. And all too often, if they don't heed the warnings, they're fired, even though that's illegal. I saw this when I was secretary of Labor over a decade ago. We tried to penalize employers that broke the law, but the fines are minuscule. Too many employers consider them a cost of doing business.

This isn't right. The most important feature of the Employee Free Choice Act, which will be considered by the just-seated 111th Congress, toughens penalties against companies that violate their workers' rights. The sooner it's enacted, the better -- for U.S. workers and for the U.S. economy.

These companies already know how to get around this problem, they simply hire 2 part time employees to replace one full time employee. They subcontract work, using temporary non-union employees, to replace having to battle the union incessantly. They've been forced to take these routes by both union and government.

Originally Posted By: jeffoThe American middle class isn't looking for a bailout or a handout. Most people just want a chance to share in the success of the companies they help to prosper. Making it easier for all Americans to form unions would give the middle class the bargaining power it needs for better wages and benefits. And a strong and prosperous middle class is necessary if our economy is to succeed.

posted by Robert Reich | 10:56 AM